The boom collapsed within six months, however, saddling the bank with enormous losses and forcing the branch to close three years later. The Bank of Nova Scotia expanded outside the Maritime Provinces in 1882, when it opened a branch in Winnipeg to take advantage of opportunities created by a real estate boom in the area. These improvements in transportation stimulated manufacturing throughout Canada, which also served to fuel the bank's development. Though local industry was declining, growth continued throughout the decade as the bank found opportunities in financing coal mining, iron, and steel businesses serving the railway and steamship lines. Menzies, who guided an expansion program that increased total assets to C$3.5 million by 1875. The bank gradually recovered from these losses through the efforts of Forman's successor, William C. Forman's embezzlement of C$315,000 since 1844. It was not until the early 1870s that the staff also determined that growth had been stunted by Mr. Over the next 30 years, the bank grew slowly in the face of increased competition from existing institutions, such as the Halifax Banking Company and the Bank of British North America, as well as from new banks opening throughout Nova Scotia. Early development, therefore, focused on establishing a foreign exchange business with agents in New York, London, and Boston, while local agencies and the main office in Halifax concentrated on making domestic loans. The bank officially opened in August 1832, a time of unfavorable economic conditions because of massive crop failures and a cholera outbreak. None of the members of the first board of directors had any practical banking experience, but this did not deter them from setting up the necessary operations and appointing James Forman, a prominent citizen of Halifax, to serve as the first cashier (as the general manager was then called). The first public financial institution in the colonial port city of Halifax, the Bank of Nova Scotia was formed on March 30, 1832, to handle the economic activity associated with the area's lumber, fishing, farming, and foreign trade. in Mexico and subsidiary operations in Chile, Costa Rica, and El Salvador.

Scotiabank ranks as the Caribbean's leading provider of financial services, has the largest presence in Asia of any Canadian bank, and maintains major holdings in Latin America, including majority ownership of Grupo Financiero Scotiabank Inverlat, S.A. Its international banking operations range across more than 40 countries and include more than 720 branches and offices and more than 1,500 ABMs. The Bank of Nova Scotia is considered to be the most international of the "Big Five" Canadian banks. Active in Canada, the United States, and Europe, Scotia Capital provides the bank's corporate, institutional, and government clients with corporate and investment banking services.

The wealth management unit, which encompasses Scotiabank's retail brokerage, mutual funds, and private clients services, has nearly three-quarters of a million clients and in excess of $82 billion in assets under management.

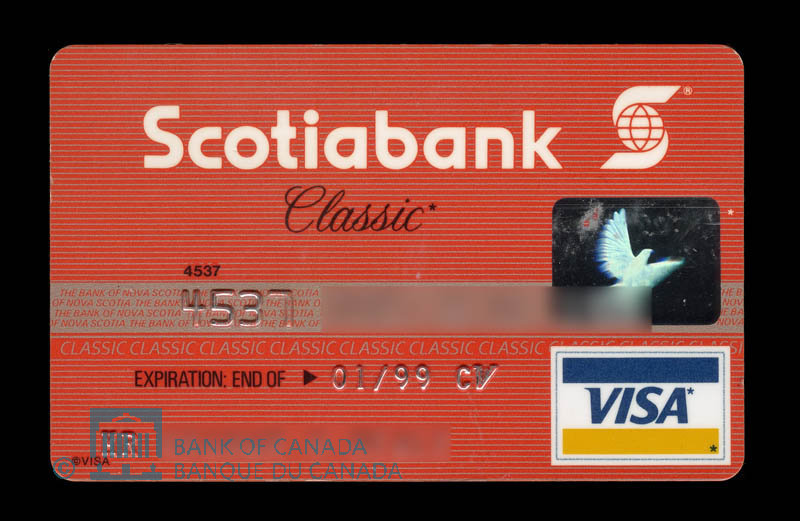

BANK OF NOVA SCOTIA BANK FULL

The domestic banking unit provides a full range of banking services to individuals, small businesses, and commercial accounts its more than six million customers are served through a network of nearly 1,000 domestic offices and close to 2,200 automatic bank machines (ABMs), in addition to telephone banking, wireless services, and the Scotia OnLine Internet banking service. Scotiabank, as it is usually called, conducts its activities through four major divisions: domestic banking, wealth management, Scotia Capital, and international. The Bank of Nova Scotia, the second oldest bank in Canada, was the second largest Canadian bank in 2003 in term of assets (trailing only Royal Bank of Canada).

0 kommentar(er)

0 kommentar(er)